Disbursement / Receiving Aid

How Does Financial Aid Pay for My Fees?

The Office of Financial Aid works in conjunction with Student Business Services to pay accepted financial aid awards to students. These payments are called “disbursements” and begin the week before classes start each semester.

Aid is disbursed to eligible students a week prior to the first day of classes each semester, and thereafter as available.

All financial aid, including Parent PLUS loans, will first be applied to institutional charges, which include: mandatory state and campus fees and housing charges (if residing in on-campus housing). Any remaining financial aid after institutional charges are paid will then be refunded to the student. Please see Student Business Services regarding issuing refunds or making payments.

Disbursement

-

Charges

-

Charges (if applicable)

=

or

Out of Pocket Expenses

Disbursement dates for 2025-2026 Academic Year

Most funds are disbursed in one lump sum (with a few exceptions see below) a few days before classes begin. The first scheduled disbursement dates are:

| Semester | Disbursement Date |

|---|---|

|

Fall 2025 |

August 13, 2025 |

|

Spring 2026 |

January 7, 2026 |

If you miss the first disbursement (due to late enrollment, for example), disbursements are regularly scheduled usually two times each week throughout the semester.

Disbursement Information & Frequently Asked QUestions

Disbursement Eligibility

You must meet all disbursement requirements in order for your aid to pay. Some of the general requirements to receive payment of funds include:

-

Submission of all required documents.

-

Meeting all satisfactory academic progress (SAP) requirements.

-

Maintain enrollment in a minimum of six units for most aid programs (four units of 500 level coursework for graduate students to receive student loan funds), see below for additional details.

Specific Disbursement Requirements:

Please note that certain student aid programs may have very specific disbursement requirements in addition to the general disbursement requirements. For example, Cal Grant and State University Grant recipients must be California residents whereas some scholarship programs require that students be enrolled full-time to receive any scholarship funds. These special requirements must be met in order for those funds to be disbursed.

How Are Funds Disbursed?

Eligible financial aid funds are paid to your campus account. Student Business Services (SFS) first pays the balance of campus charges (including tuition, campus fees, and on-campus housing charges) then any remaining funds would be refunded to the student. Refunds are distributed by SBS in the form of a paper check via USPS or ACH Direct Deposit (if activated by the student). Additional information available from SFS:

Important Note for On-Campus Housing Residents

On-campus room and board charges are posted to the student account. Financial aid funds (including Parent PLUS Loan funds) are disbursed to the student account and will be applied first to institutional charges including mandatory tuition and fee charges as well as to housing charges (if applicable). Any funds remaining after institutional charges have been paid will be issued to the student via a mailed check or ACH Direct Deposit. Any remaining PLUS Loan funds would be mailed in the form of a check to the parent borrower.

It is the student's responsibility to pay for charges not covered by financial aid resources.

How MucH WILL I RECEIVE?

How much funding you receive depends on the number of units you are enrolled in and what type of financial aid you have been provided. Generally, undergraduate students enrolled in 12 or more units would receive 100% of their semester funding at the beginning of the semester. There are exceptions to this due to enrollment status or programs with multiple term payments.

ENROLLMENT STATUS

The enrollment status of the student at the time that funds are prepared for disbursement will be used to determine the payment amount. For purposes of financial aid, enrollment status is defined as outlined in the table below.

-

Please keep in mind that most financial aid funds are disbursed in two payments for the academic year, half for the fall term and half for the spring term. You can view your financial aid by semester on your student center by detailing into each term.

-

Loans are not prorated. The full amount of loan funds for the semester will be disbursed as long as the student is enrolled in a minimum of six units. For students enrolled in a graduate program, 500 level or higher coursework will be weighted at 1.5 units. Example: 4 units (500 level or higher) x 1.5 = 6 units, which meets the unit minimum requirement for loan disbursement.

-

If you are enrolled part-time (fewer than 12 units), you may receive a partial payment of Cal Grant, State University Grant, Federal Pell Grant or EOP Grant. If your enrollment status increases so that you qualify for additional funds, you may receive a supplemental payment.

| Undergraduates | Graduate Students | |

|---|---|---|

| Enrollment |

Number of Units |

Number of Units |

|

Full-Time |

12 or more |

9 or more |

|

¾ Time |

9 - 11 |

7 - 8 |

|

½ Time |

6 - 8 |

6 |

|

< ½ Time |

5 or less |

5 or less |

PRORATED & SPLIT PAYMENTS

Prorated Payments

Disbursements of Pell Grants, Cal Grant A, Cal Grant B and Cal Grant B Access will be prorated (adjusted) based on the enrollment status of the student. Your financial aid award summary reflects your full-time award amount; payment amounts will be prorated if necessary based on the enrollment status at the time the disbursement is completed.

How will my Pell Grant Payment or Cal Grant Payment Change due to Enrollment Changes?

Pell Grant and Cal Grant funds are disbursed based on the enrollment status at the time of disbursement.

Pell Grant Recipients

Pell Grant recipients who change enrollment status (adding or dropping classes) will have their eligibility recalculated based on their enrollment status as of the University's census date for each semester, typically the beginning of the fourth week of class. Students who are enrolled less than full-time at the time of the initial disbursement and who later add classes prior to the University's enrollment census date (beginning of the fourth week of classes), will receive a subsequent disbursement based on the new updated enrollment status to reflect the correct payment eligibility (3/4 time or full-time). Likewise, Pell Grant funds will be recalculated for students who drop classes and the revised Pell Grant will be based on "census" enrollment status. In some instances, this recalculation may result in repayment of funds already disbursed as a result of the reduction in units following the disbursement of Pell Grant funds.

Cal Grant Recipients

Cal Grant funds are disbursed based on the enrollment status at the time of disbursement. Following the initial disbursement, Cal Grant recipients who change enrollment status (adding or dropping classes) will have their eligibility recalculated based on their enrollment status as of the end of the University's census date for each semester, typically the beginning of the fourth week of class. Students who are enrolled less than full-time at the time of the initial disbursement and who later add classes prior to the University's enrollment census date (beginning of the fourth week of classes), will receive a subsequent disbursement based on the new updated enrollment status to reflect the correct payment eligibility (3/4 time or full-time). Likewise, Cal Grant payments funds will be recalculated for students who drop classes and the revised Cal Grant payment will be based on "census" enrollment status. In some instances, this recalculation may result in repayment of funds already disbursed as a result of the reduction in units following the disbursement of Cal Grant funds.

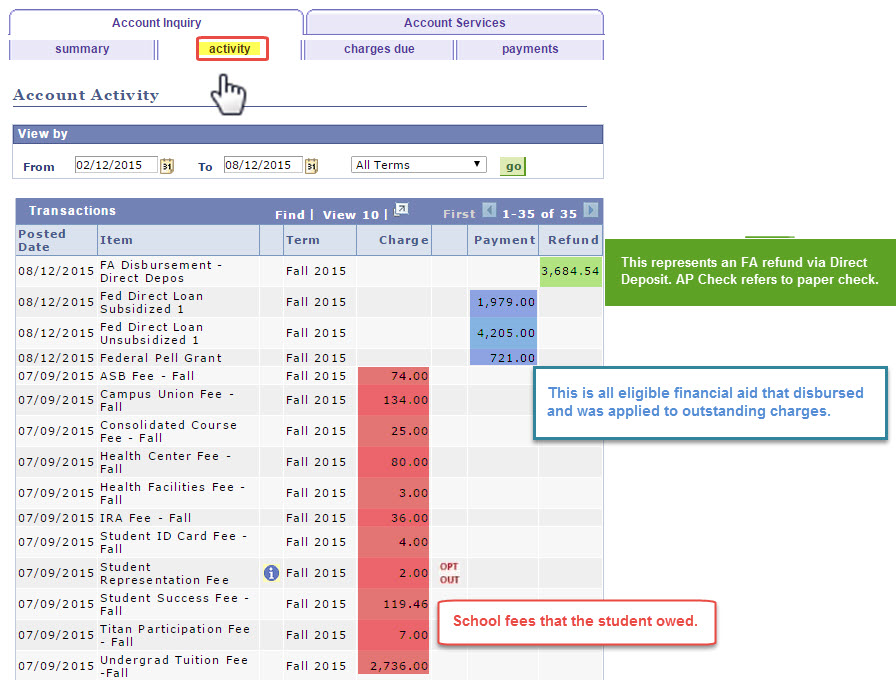

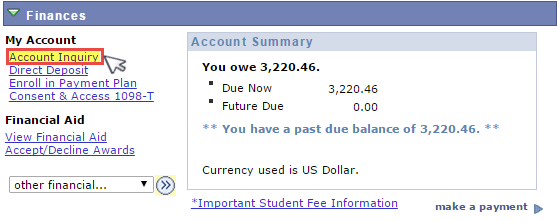

Reviewing Your Campus Account

All students have access to view charges, payments, and refunds on their Student Center. Reviewing this regularly will ensure that all your fees and balances are cleared in a timely manner.

Account Inquiry Guide

Below is a guide to access and understand your account inquiry on your Student Center.

TERMS AND CONDITIONS

When you accept a financial aid payment, you are agreeing to the terms and conditions of your financial aid.